In the past few years, music streaming has suddenly become one of the most crowded spaces in tech. Established players such as Spotify and Pandora are fighting off challenges from some of the biggest tech players in the world. Apple Music launched with 11M users in its first month, Amazon Prime Music - visually a Spotify clone - comes at a great price point for Prime subscribers (free), and now YouTube Music is launching as a standalone app. Even this ignores other strong players in the space with large non-US user bases, such as LINE and Deezer.

Arguments have been made for each of these platforms "winning streaming," mostly focusing on things like Apple's dominance of mobile hardware, YouTube's ubiquity and free features, Spotify's analytical intelligence and strong product design. But what does "winning" entail? Is it being the largest platform, having the strongest product, having the most momentum?

For the moment, this space is significantly fragmented and consumers often use multiple music solutions, showing loyalty to none. Each company uses different channels to promote their product (Spotify and telco deals, Apple and iOS devices) and differ in strength on mobile. This creates an opportunity for any of them - and perhaps the largest opportunity for one of the only major tech players without a standalone music service. Facebook.

Facebook also had a major product announcement recently - "Music Stories", a feature launching initially to Facebook's iOS app users. The feature allows users to play songs shared directly from Spotify and Apple Music on their news feeds and instantly add those songs to their music libraries on those services. For the moment, users can't stream more than short 30 second samples on Facebook, and those are the only two services supported at this time. That's a modest start for Facebook, which has previously supported Spotify integration.

Why is this Facebook's play? For instance, why haven't they yet launched a standalone music service? Signs already point to Facebook making an even larger push into music, and they have already invested heavily in the success of their video product. I'll examine what Facebook might be doing, and who they might have learned from.

How To Fail At Music Streaming

We get a better idea of Facebook's motives when we look at one competitor in particular: Apple Music. Launching in July, Apple Music boasted an impressive 11 million listeners in its first month of availability, but by October had only added 4 million more. 6.5 million of these listeners were paying for the product, leaving the remainder (8.5 million) as free-trial users. While this may initially seem like a decent retention rate, user growth was clearly awful in the intervening months, especially considering the massive amount of available iOS devices that could simply sign up for a FREE TRIAL.

So what happened? Apple relied on a massive initial marketing push, which briefly boosted awareness of the product, but neglected to add any strong social features at launch. Without the virality enabled by direct sharing of songs, Apple Music relied on word of mouth after launch to attract users - and often that word of mouth was not good.

What happens when products neglect virality as a growth mechanism? They don't attract new users, and then they die. In fact, Apple Music did their competitors a favor by educating users about the ease of streaming music and failing to capture any of them. The biggest reason: there were no significant network effects associated with use of the Apple Music product. With no free tier on Apple Music to retain users who were on the fence, Spotify and YouTube were the beneficiaries of new music streamers who were unwilling to subscribe to Apple Music after their initial trial period subsided.

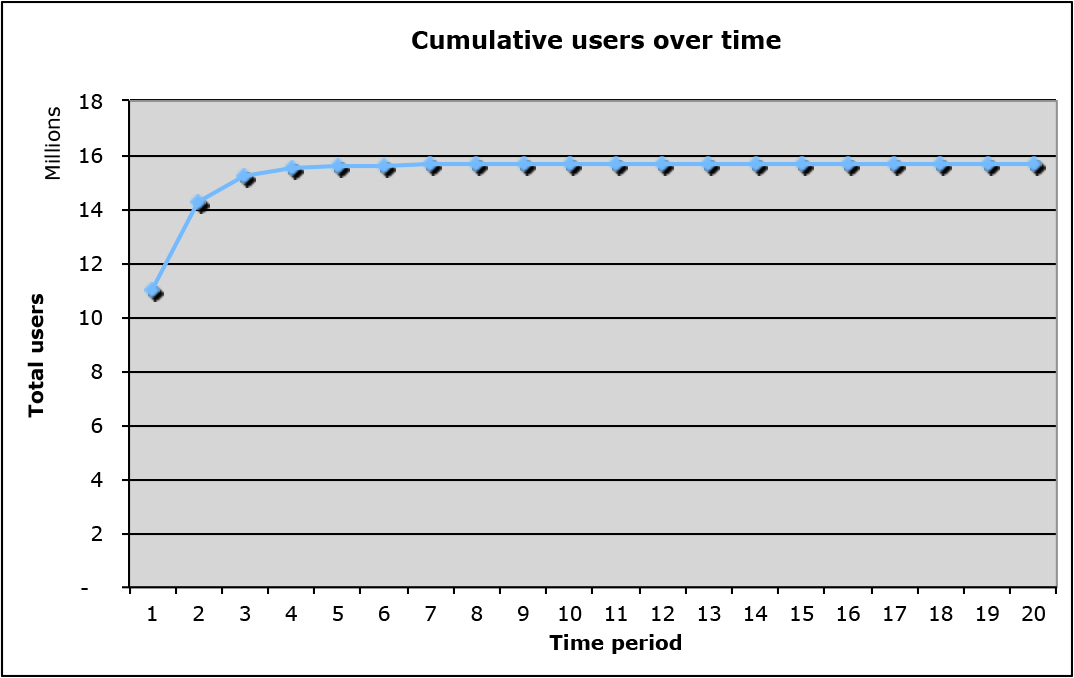

I used Apple's own published numbers on conversion rate and user growth to project their growth based on a virality model (see Andrew Chen's post). If we attribute every single new user to viral growth and reverse engineer the viral model from their numbers, each Apple Music user was responsible for attracting 0.3 additional users to the platform (a high number, considering many new users simply discovered the app through updating their OS). If we keep the retention rate constant (and the overwhelming evidence suggests it may decrease), Apple Music's organic viral growth should flatline around month 5. Which is to say - now. And that's just for free trial uptake.

What may boost their success above this organic line might be additional marketing efforts, new iOS users, expanding to Android platforms, or actually building strong user-to-user social sharing features, but the damage is already done. 11 million users in the first month were dumped into a terrible funnel, and most have already leaked out to competitors. Apple blew it.

Apple Music's hockey stick seems to have fallen down.

These abysmal growth numbers are corroborated by Google Search trends, which normally does a pretty good job of mirroring things like app adoption.

Yes, Apple Music is the red line.

The Opposite of Apple - Embracing Social

So if you're a consumer who's finally willing to pay for streaming, who do you use? It may be the cheapest platform, or the one you are most familiar with, or perhaps the one that already integrates with services you use - this is YouTube's hope with including their premium music product bundled with YouTube Red. The one place you clearly won't go? Facebook, because they don't have a complete music streaming solution. No full songs, no expansive library, no discovery tools. So how does Facebook get started with launching its own music streaming solution? By attacking other services where they are weakest, and where they are strongest - social.

Facebook is unlikely to want to compete on price - undercutting the market and providing extensive free trials doesn't work as a standalone strategy, as Apple proved. It could compete on product, but a superior product does not necessarily guarantee consumer adoption.

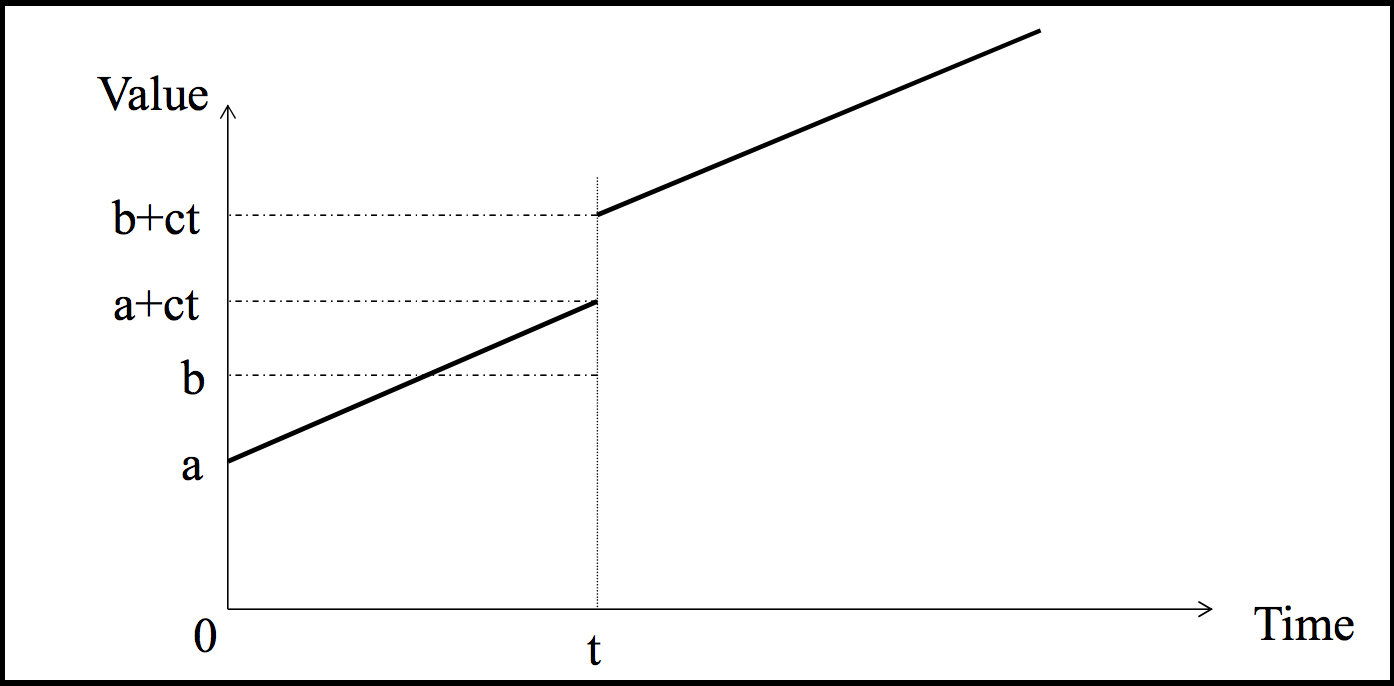

Consider the following model, which I have adapted from SInan Aral's lecture notes. (Sinan is an MIT Sloan professor and researcher focusing on product virality.)

Product A launches at time 0 with an inherent value of a. Product B will launch at time t in the future with an inherent value of b, where b is greater than a. Both products add users at a rate of one user per time period, meaning product A will have t users at time t, while product B will have zero. Each product exhibits network effects, and the two products are substitutes, not complements. This network effect, c, is multiplied by the number of users of the product and added to the product's inherent value. The value of each product over time is shown below.

Image adapted from slides by Sinan Aral, MIT Sloan professor

A new user entering at time t will see the marketplace as described above: product A's value is superior to that of product B, even if product B is inherently more valuable or complete. This new entrant will thus choose product A, especially if influenced by his or her close friends (who may already be users of A).

Imagine product A here is Spotify, which gains in utility as more users join the service. It has a substantial amount of data at its disposal and a large amount of fluency when applying the data towards improving their product (thanks in part to its acquisition of the Echo Nest). It also has a nominal amount of social features, though they are poorly designed and difficult to find. Even if a superior product launches at a later date, new entrants to the marketplace are likely to choose Spotify due to network effects. In addition, existing Spotify users are likely to continue using the product (especially with new personalized features such as Discover Weekly).

However, imagine a different product B - one that builds upon the existing user base of product A and functions as a complement, not a substitute. Now at time t, we see a different marketplace:

Image adapted from slides by Sinan Aral, MIT Sloan professor

Clearly the math has changed for the new entrant. B now looks more attractive due to its higher inherent value as a product and can capture new users. My intention here is obvious - Facebook is attempting to be product B and avoid the fate of product A. And of course, Facebook has its own social graph to leverage in addition to that of the products they're piggybacking upon.

Facebook must see an opportunity to be the missing social component for all music streaming products and thus leverage the total cross-platform streaming user base instead of first attempting to dump a complete solution on its captive user base. Apple attempted to use its captive hardware users to expand its own music platform - it's not a winning strategy.

Why else might Facebook do this? By encouraging users to share their musical tastes on Facebook, they capture data on the musical tastes of existing streamers BEFORE launching a standalone product. This allows for greater personalization and overall user intelligence.

Facebook is attempting to construct a habit loop for users, and the video at the top of the article demonstrates this clearly. Use music streaming app. Copy song link. Go to Facebook. Share. What is the key to this loop? Leave your app, and come to ours, because we have the best sharing functionality.

This works because music is inherently a social experience, one shared between listeners in addition to between artist and fan. Apple overinvested in the latter relationship; Spotify initially leveraged the former but has lost its social strength as the product grew in complexity. Now Facebook is building the streamlined social music sharing feature Spotify should have had - and as a result, they are building a core user base conditioned to share and discover music outside of their current music streaming app of choice. Then, when Facebook finally launches its own standalone music streaming solution, it has already introduced network effects and a habit loop for users.

And crucially, this sharing functionality is free. This means they attract the widest possible user base to begin with, not just a subset of already engaged premium music streamers, who may be the hardest to initially pry away from existing services.

As we've seen, Facebook is learning from its past relationship with Spotify and from the failures of its competitors. But any number of things could affect the future growth of their music products, from the quality of the eventual product to market positioning and price point. How long it takes Facebook to launch their own music streaming product will also be crucial - wait too long, and they risk losing users to the competitor services it is promoting in the News Feed. Move too quickly, and they won't reap the benefits of their current partnership strategy.

And of course, competitors aren't standing still. YouTube Music is just getting started. Apple has billions in the bank. Spotify is still growing like crazy and adding video and podcast support. The list goes on.

So grab your popcorn and enjoy the plethora of amazing musical solutions we currently have as consumers. The battle is just beginning.